Case H2 Green Steel

Equity

Normally, industrial start-ups raise seed funding from either financial (venture capital, family offices, etc.) or strategic investors to begin the project planning, pre-engineering and design, permitting and capital raising process. At the very beginning of project development is also important to evaluate potential government backed grant opportunities to support the development phase of the project.

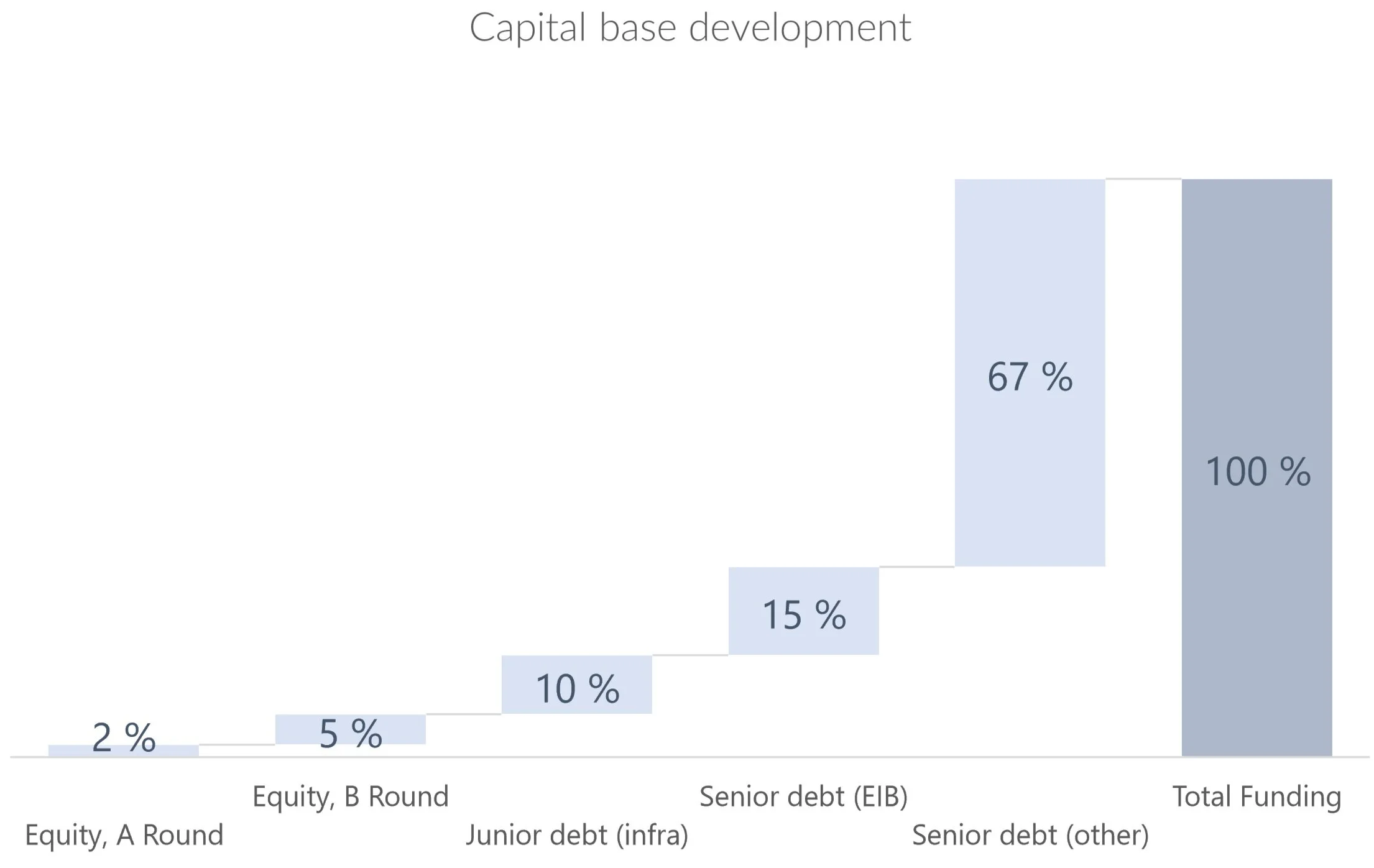

The next step is to attract more equity capital to accelerate to project development process. When we look at H2 Green Steel, they raised some EUR 100 million or 2% of the total project funding at this stage. The next equity round was to extend the first one and company raised EUR 260 million (5% of total). Investors included both financial investors such as European family offices and pension funds but also strategic investors such as customers and material suppliers, etc.

From the financing and project feasibility perspective it is also vital to attract enough customer support by e.g., signing purchase agreements and secure the relevant raw material streams e.g., power purchase contracts for the operations. There is a spectrum of e.g., different off-take requirement levels depending on the product and market the company is going to engage in.

Debt

After the equity part looks solid, it’s time to look at potential debt alternatives to minimise dilution and optimise the cost of capital for the funding. In the case of H2 Green Steel, the company was able to secure a EUR 500 million junior loan (10% of the total funding) from an infrastructure investment fund. To finalise the funding need, the government steps in. In this project, EIB provided the company with a EUR 750 million senior debt facility that amounted 15% of the total funding.

Moreover, Swedish Export Credit Agency together with European credit institutions provided a EUR 3.3 billion debt financing covering 67% of the total funding need.

Guarantees

To support the senior debt financing, the company arranged EUR 1 billion credit guarantee from governmental institution, Swedish National Debt Office. Moreover, export credit guarantees worth of EUR 1.5 billion were arranged from a large private export credit provider. These guarantees covered some 60% of the senior debt facilities.

Summary

Below one can see the total funding structure waterfall and respective shares of funding types. In this example, we can observe how the total funding of the project requires less than 10% equity. Even this is just an individual case example, it should be noted that when structured optimally, a green field project can attract a significant amount of debt capital and government subsidies. This case provides an example how industrial start-ups can holistically use a variety of funding instruments to optimise their capital structure and cost of capital.

.jpg)

.jpg)