1. Updated outlook for 2023: Entering a valley of low access to funding but with pockets of opportunity

We see the biggest funding opportunities for our customers in alternative debt, growth equity, and public finance initiatives.

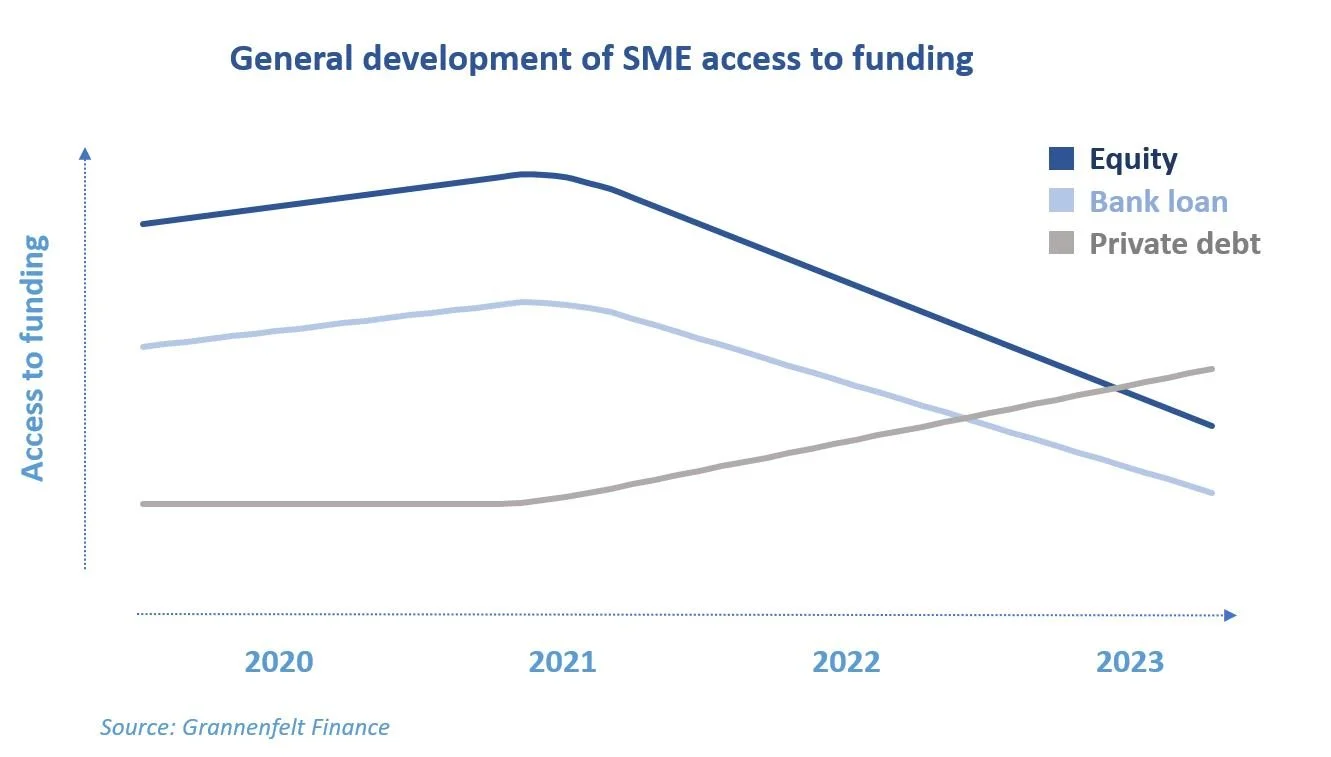

We expect the market turmoil in the banking sector together with the interest rate environment to decrease access to funding for companies in general. Banks are likely to tighten their credit risk policy from here on out and this further decreases access to funding. At the same time, cost of funding increases.

The increased expectations of a “hard landing” in the economy – i.e., risk of economic slowdown or recession – will further limit risk appetite across financiers and investors. This is in addition to changes in investor appetite and cost of funding that we already saw last year. Throughout 2022 as interest rates and inflation came up, market valuations came down and recession fears were looming – access to funding was tightened. This had particularly notable consequences for companies that were raising equity. Now the credit market has tightened up as well.

The increased cost of funding means that companies face a higher requirement on expected internal return for new investments. Weakened economic growth prospects speak for a focus on profitability rather than growth prospects. This we saw already in 2022 and the outlook remains the same. The interest rate environment further speaks for decreasing valuations in 2023.

We see the biggest funding opportunities for our customers in alternative debt, growth equity, and public finance initiatives. This decreases the need for dilutive equity. Most importantly, it allows for more time until the next funding round. As the banking sector restricts lending due to regulatory or public market sentiment, the private debt market can fill the gap as it has seen historically large allocations. On the equity fundraising side, allocations remain strong for green transition and impact investments. Green transition and sustainability projects will in 2023 also become increasingly in focus for bank and private debt lending.